The transition to cleaner energy resources is an essential step towards achieving the world’s climate change goals. In 2020, the world invested over USD300 billion in renewable energy.2 This trend is encouraging; however, while often perceived as the end goal of climate mitigation action, achieving clean energy should not be the finish line for sustainable development.

In this article, we want to highlight three points:

- the hidden environmental impacts of renewable energy,

- the need for a whole of value chain analysis when considering how to decarbonize production processes,

- the virtuous cycle between decarbonizing the renewable energy sector and decarbonizing its raw material input sector.

Examining the role of copper in the renewable energy value chain is useful in illustrating the above challenges. While copper production is far from being the largest source of carbon emissions, it is nonetheless gaining importance as the renewable energy sector scales up. Copper, as a conductor for electricity and heat, is essential in all energy generation applications, including renewables. Take wind turbines, for example. An average offshore wind turbine requires six times more copper than a coal-fired plant to produce the same amount of electricity.3 Estimates suggest that by 2028, 5.5 million additional tons of copper will be demanded globally just from wind farm expansions alone.4

So, what are the environmental impacts of copper production?

Source: AIIB staff

There are multiple polluting processes during copper production. Each ton of copper produced emits 60 kilograms (kg) of sulfur and nitrogen oxides, which are a key cause of acid rain. Other toxic elements, such as arsenic and lead, are also emitted to both air and water.5 The threat of eutrophication, or “the process of enrichment of waters with excess plant nutrients, primarily phosphorus and nitrogen, which leads to enhanced growth of algae, periphyton, or macrophytes” is substantial because copper production also discharges ammonia, nitrate and phosphates into water. In 2020, Escondida, the largest copper mine in the world, emitted 10,595 tons of nitrogen oxides and discharged 99,740 tons of “Type 3” water, i.e., water that requires significant treatment to meet drinking water standards.6 Additionally, solid wastes are a long-term concern. One ton of copper generates 157 tons of tailings, which usually contain toxic or radioactive substance, and must be properly stored and monitored for decades.7

In fact, many towns that host depleted copper mines have become ghost towns, unsuitable for living. Rehabilitation is not easy. Incentives for mining companies to commit to post-production treatments of local areas may be insufficient, even if companies publicly announce closure plans.

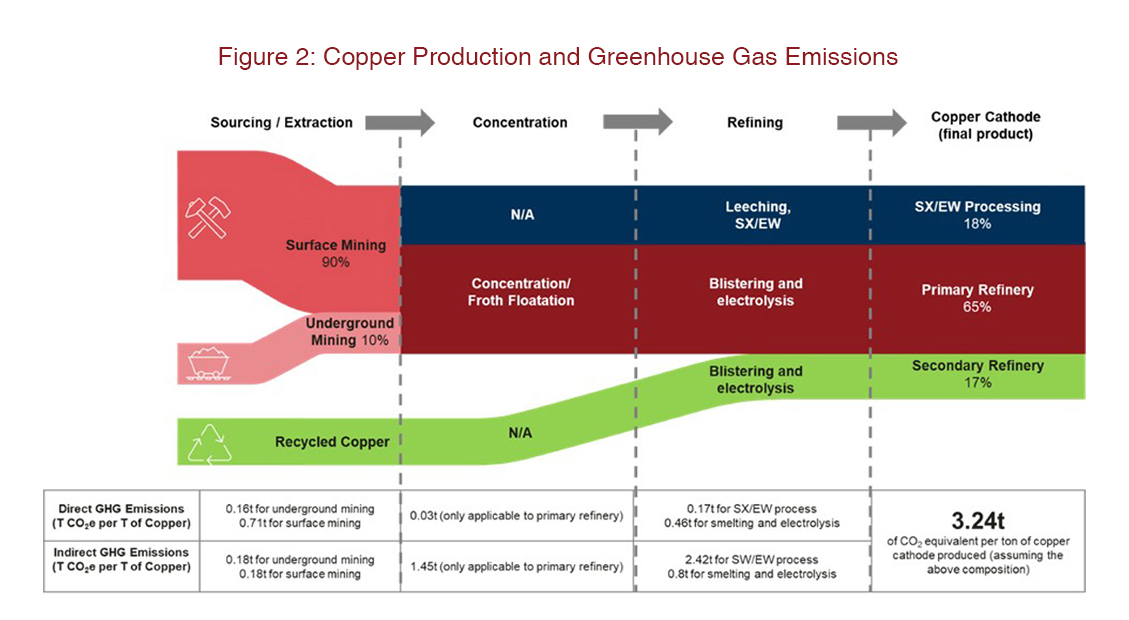

Greenhouse gas emissions pose another sustainability challenge in copper production. Referring to Azadi et al. (2020),8 we estimate that producing an average ton of copper generates 3.24 tons of carbon dioxide (CO2) equivalent greenhouse gas (GHG) emissions (see Figure 2).

Source: AIIB staff calculations; breakdown of copper production by method taken from International Copper Study Group. 2017. World Copper Factbook 2017.

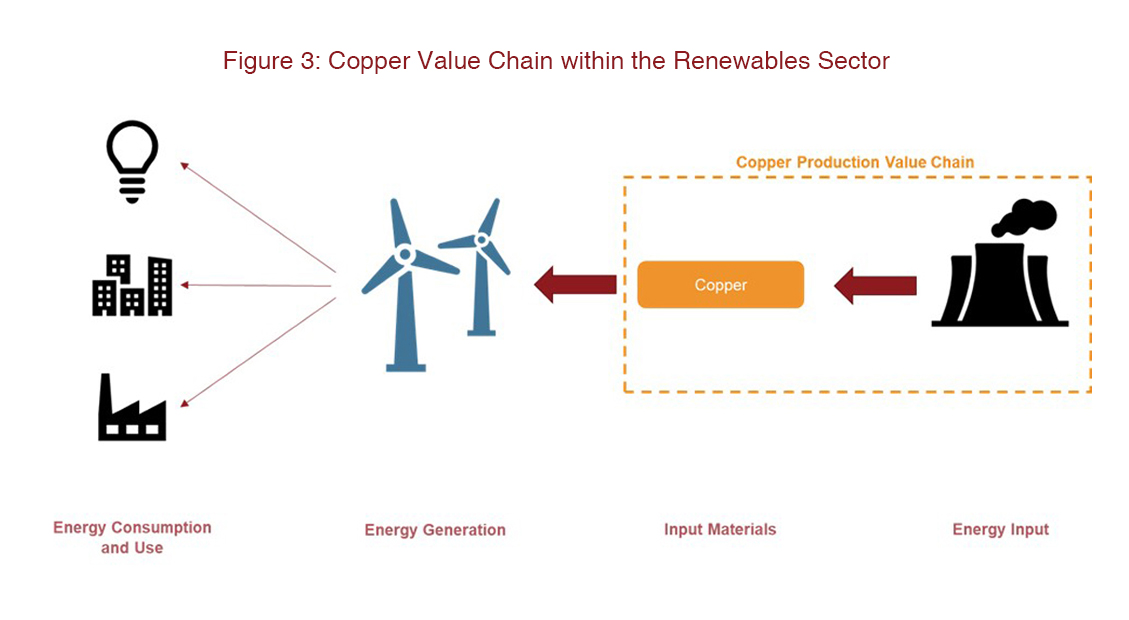

Dissecting this number further, we find additional upstream issues. In the copper production value chain, two types of GHG emissions exist: direct emissions from copper production, and indirect emissions caused primarily by the generation of energy needed in the production process (see Figure 3).

Source: AIIB staff

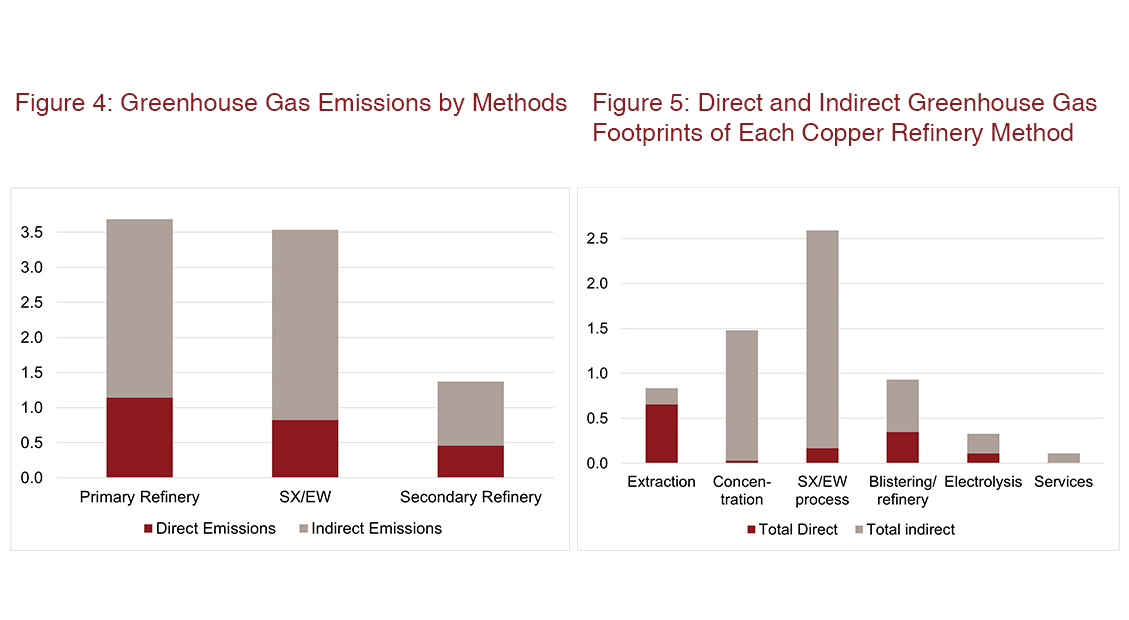

We find that upstream indirect emissions account for the bulk of emissions in every production method. For example, we estimate that in the SX/EW process (solvent extraction/electrowinning), roughly 70-80 percent of the GHG emissions are generated indirectly by the mostly coal- and natural gas-based power plants supplying the electricity needed for the process. The same observation on indirect emissions holds true across most stages of copper production (see Figure 4 and 5).

Source: AIIB staff calculations

Thus, if we were to decarbonize copper, we need to consider the whole value chain and actively engage in greening power generation methods.

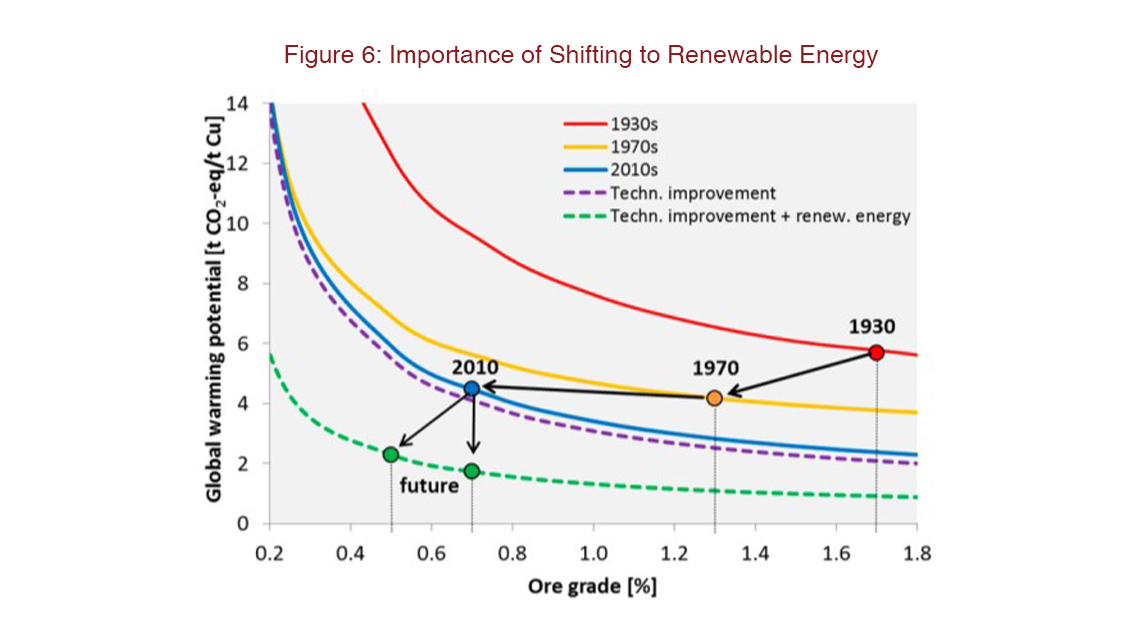

Source: Rötzer and Schmidt. 2020. Historical, Current, and Future Energy Demand from Global Copper Production and Its Impact on Climate Change. Resources, 9(4), 44.

This proposition is supported by Rötzer and Schmidt (2020).9 As shown in Figure 6, energy efficiency and technology improvement alone (purple line) are not sufficient to cut down a substantial amount of GHG emissions in copper production. Only if accompanied by a shift to renewable energy as the source of power (green line) can the GHG emission in the copper production process be meaningfully reduced.

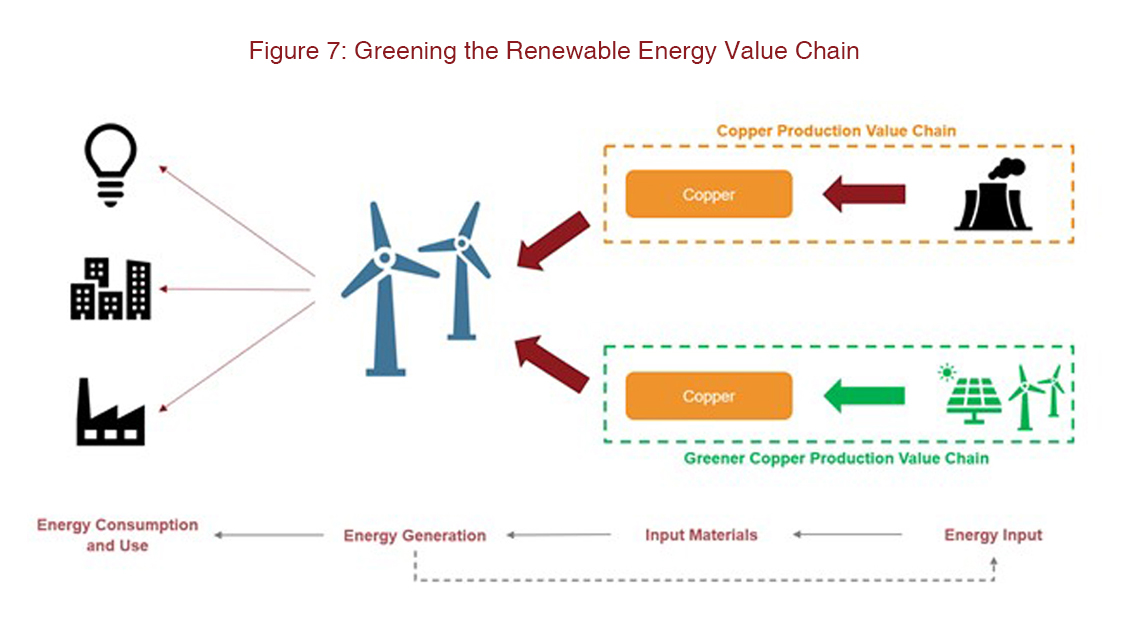

Thus, the greening of copper production and of energy sources are mutually reinforcing. On one hand, copper is essential for building more green energy generators; on the other, adopting greener methods of energy generation can produce copper in a greener way (Figure 7).

Source: AIIB staff

In conclusion, using the case of copper, we tried to demonstrate the importance of adopting an integrated value-chain approach to evaluating environmental impacts and designing future sustainability actions. To build a sustainable future, it is not sufficient to narrowly focus on a single component. It is essential to trace upstream to the original goods and services, identifying the sustainability challenges as well as the potential opportunities across all components. The renewable energy sector is no exception. Additionally, greening this sector’s value chain will create a virtuous circle of more green energy powering the production of even more green energy.

1 Sinan Li is currently a graduate student at the London School of Economics. Mingkun Wu is currently a graduate student at Sciences Po and Columbia University (SIPA). Jintao Zhu is currently a graduate student at the University of Cambridge. The blog has been written while the authors were on a summer Research Assistant assignment at AIIB. The authors want to thank Marcin Sasin (Senior Economist) and David Morgado (Senior Energy Specialist) for their guidance.

2 Bloomberg. 2021. Energy Transition Investment Hit $500 Billion in 2020 – For First Time.

3 IEA. 2021. The Role of Critical Minerals in Clean Energy Transitions.

4 Wood Mackenzie. 2021. Global Wind Turbine Fleet to Consume Over 5.5Mt of Copper by 2028.

5 Istvanovics, V. 2021. Eutrophication of Lakes and Reservoirs.

6 BHP. 2020. Annual Report 2020.

7 International Copper Association. 2018. Copper Environmental Profile.

8 Azadi, M., Northey, S. A., Ali, S. H., and Edraki, M. 2020. Transparency on Greenhouse Gas Emissions from Mining to Enable Climate Change Mitigation. Nature Geoscience, 13(2), 100-104.

9 Rötzer, N., & Schmidt, M. 2020. Historical, Current, and Future Energy Demand from Global Copper Production and Its Impact on Climate Change. Resources, 9(4), 44.