As borders close to contain COVID-19, another door begins to shut—global trade in medical goods.

Face shields, gloves, hand sanitizers, protective garments and visors are necessary equipment for health professionals in the face of COVID-19. Thermometers, ventilators and syringes are essential in treating patients.

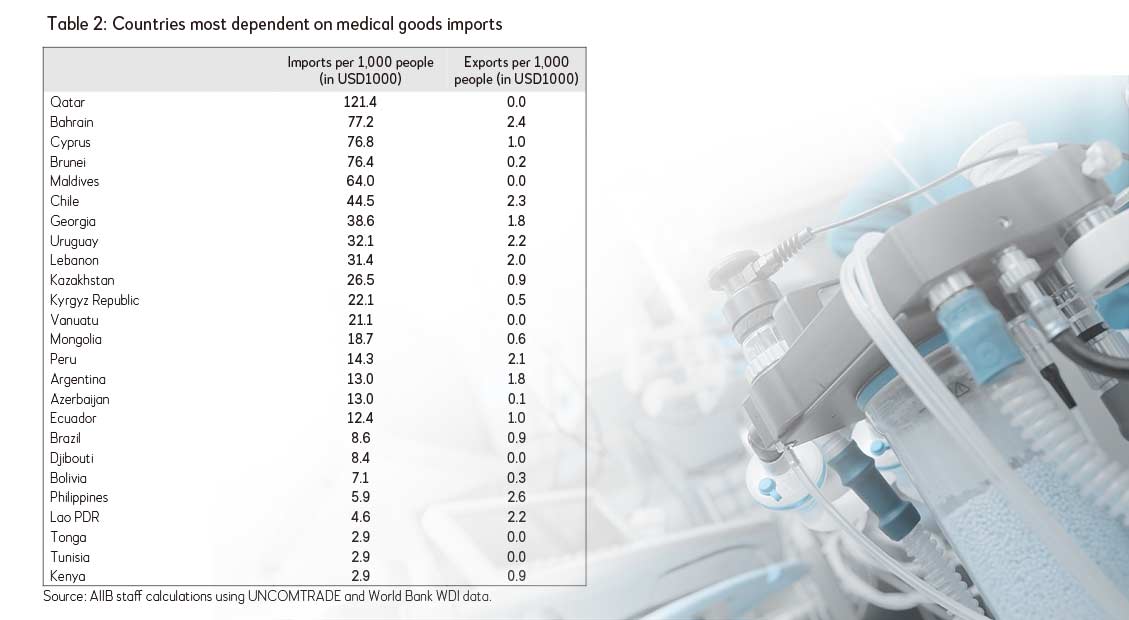

Many rely on a few countries to import these goods. Among AIIB members, which represent close to 80 percent of the global exports of medical goods, only two countries (China and Germany) produce medical equipment in significant proportions (at least 10 percent of global exports). An additional 15 AIIB members are indirectly involved in medical goods exports (export share between 1 and 5 percent) through regional value chains by producing inputs for the final production by China and Germany. Table 11 above shows that AIIB members represent a substantial share of imports and exports of different types of medical goods.

As countries race to flatten the COVID-19 infection curve, trade in medical goods is becoming restricted, leading to its own flattening. A report by the Global Trade Alert (2020)2 shows that 24 countries had restricted exports of medical equipment, medicines or their inputs starting March 2020 by imposing export bans or limits. Many of these are advanced economies that announced restrictions on sales of masks and other protective equipment abroad.3 Developing countries are following suit (such as restricting exports of an unproven drug believed to treat COVID-19).4

Countries have reasons for imposing export restrictions, namely limited domestic production capacity and an overwhelming sudden global demand for medical gear. Yet, medical trade protectionism is creating a double-edged sword. Countries with the means to produce medical products can flatten the curve faster at the expense of non-producing countries. That is, countries dependent on medical goods abroad will face difficulty containing the virus given unfulfilled orders of masks, ventilators and other necessary medical apparatus.

In terms of the magnitude of the potential impact of export bans, if these 24 countries implemented a total export ban on medical goods, as much as half of exports of such products would be affected. This may lead to considerable disruption of the global economy. The proportion of AIIB members’ imports affected by these export bans is expected to be around 70 percent. Poorer and more vulnerable countries would be most affected. These countries are more likely to have poor health systems (amplifying the medical goods shortage crisis). Local firms cannot be expected to start producing much-needed medical supplies overnight to serve their affected populations.

Table 2 lists the countries most dependent on imports of medical goods. They import medical goods, but either do not export them or export quite insignificantly. Low-income and developing countries are the ones with significant import needs (for example, the Maldives imports a substantial USD64,000 worth of medical goods for every 1,000 of its citizens). This dependence makes them vulnerable and less capable to address health crises.

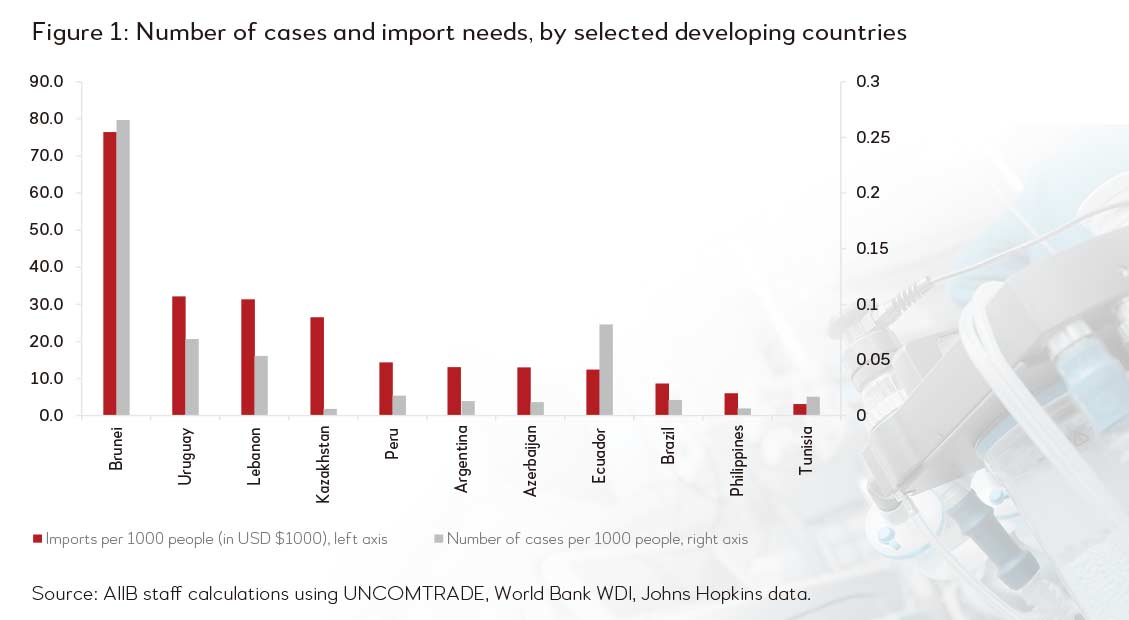

Figure 1 lists top importing developing countries and their corresponding number of COVID-19 cases. It shows that while many developing countries have fewer COVID-19 cases to date (compared to Europe, China and Iran), it is possible that lack of medical goods equipment would become a paramount concern when cases increase further.

In any healthcare emergency, assisting developing countries to finance and procure medical supplies must be a priority. For example, AIIB has financed emergency healthcare supplies for China and stands ready to finance such operations for other members.5

The imperative to assist more vulnerable countries also extends to export bans. In this regard, there are a few points to note:

- No country is entirely safe if the virus is still spreading in other parts of the world. It could always get out of control and reimported. Helping others contain COVID-19 elsewhere is in everyone’s best interest. The use of medical equipment should be optimized across the globe, not within countries.

- The consequences of protectionist actions today can have damaging long-term effects. One premise of international trade has been that of comparative advantage—countries are voluntarily foregoing production capacity of certain goods (including those critical to national security) to concentrate on the production of other goods. This arrangement has spread global prosperity over the past decades. Yet there has always been a reciprocal promise of access to such goods in this international division of labor (through imports). If this reciprocity is broken during emergencies, these beneficial arrangements may fall apart to everyone’s detriment.

Given a sudden and large global demand shock for medical goods, and to enable and encourage countries to remove their export bans, there should be a coordinated and systematic effort to quickly increase production of critical medical supplies, wherever capacity exists. Such adaptability is one important element of a resilient health infrastructure.

1 Classification of medical goods is based on Bown. 2020: https://www.piie.com/blogs/trade-and-investment-policy-watch/eu-limits-medical-gear-exports-put-poor-countries-and.

2 Global Trade Alert. 2020. Tackling Coronavirus: The Trade Policy Dimension.

3 Financial Times. 2020. European Commission warns member states on mask export ban. https://www.ft.com/content/1bbdfbd0-5fbe-11ea-b0ab-339c2307bcd4;.

Bloomberg (2020). The Global Mask Shortage May Get Much Worse. https://www.bloomberg.com/news/articles/2020-03-10/the-global-mask-shortage-may-be-about-to-get-much-worse.

4 Financial Times. 2020. Global rush for coronavirus drug sees India stop exports. https://www.ft.com/content/dc8386ba-6eae-11ea-89df-41bea055720b?emailId=5e7bcfa71f96d6000452a675&segmentId=60a126e8-df3c-b524-c979-f90bde8a67cd.

5 AIIB. 2020. AIIB to Invest in Emergency Public Health Infrastructure in China. https://www.aiib.org/en/news-events/news/2020/AIIB-to-Invest-in-Emergency-Public-Health-Infrastructure-in-China.html.