The demand for low-carbon technologies like solar panels, electric vehicles and batteries is set to rise as countries work toward achieving their emission targets. Meeting this demand will require scaling up production capabilities and maintaining open trade flows. For many emerging markets and developing economies, access to the latest clean tech is crucial for cutting emissions and staying competitive. Without it, they could struggle to decarbonize industries and even risk losing access to key export markets, like the EU, which is already rolling out carbon border taxes.

This article examines how trade dynamics between advanced and developing economies are shaping access to low-carbon technologies (LCTs) in developing markets. To support this analysis, we use LCT data from various sources (International Centre for Trade and Sustainable Development [ICSTD], World Bank, IMF and the World Trade Organization [WTO]) to compile a consolidated list of 237 products, including wind turbines, solar photovoltaic (PV) cells and panels, biomass systems and electric vehicles (EVs).

Stagnation of LCT Exports from Advanced to Developing Economies

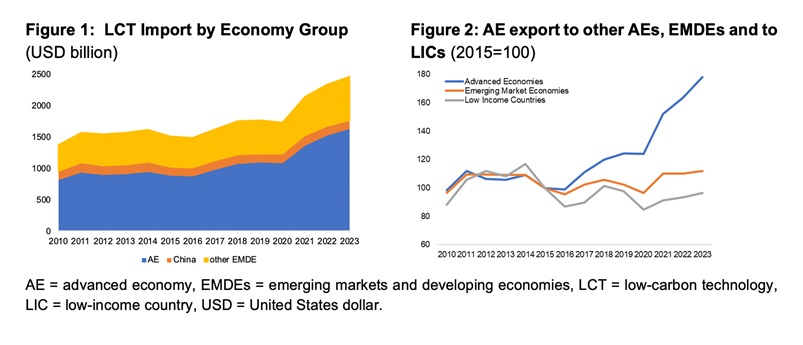

LCT products are in high demand, and trade in these products has grown rapidly—up 63% from 2015 to 2023. AEs have seen the biggest increase, with an 83% jump in LCT imports, while EMDEs have seen a smaller rise of 34% (Figure 1). In fact, most of the LCT trade is happening between AEs, with very few LCTs being exported to developing economies. Since 2015, exports of LCTs between AEs have soared by 78%, but exports to EMDEs have only grown by 12%, and exports to low-income economies have actually dropped by 4% (Figure 2). Some of the key LCTs traded among AEs include EVs, public transport vehicles, and biofuel-related chemicals.

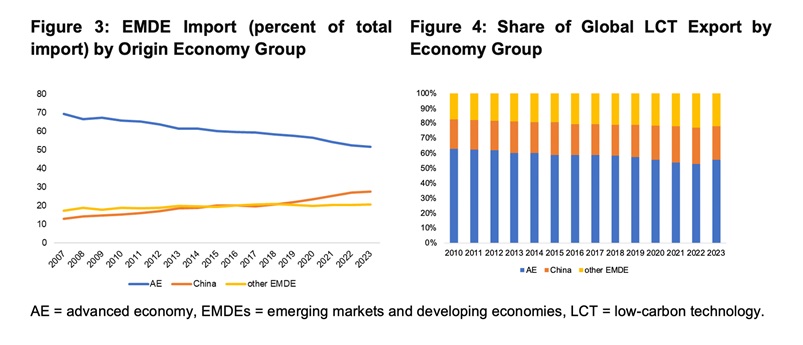

Trade in LCTs is also growing among developing economies, with China leading as the main supplier (Figures 3 and 4). However, this growth isn’t enough to drive real progress in both development and decarbonization. Some developing economies are trying to include LCT production in their growth plans, but they need better access to foreign technologies and more investment to succeed.

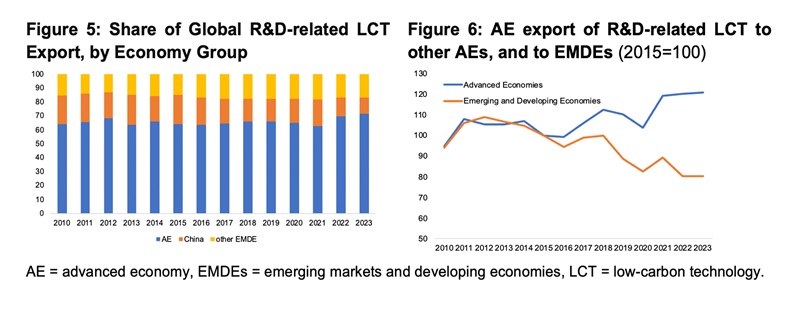

The situation gets even more challenging when LCT products related to research and development (R&D) are examined. These include high-tech items tied to renewable energy research, like hydrographic instruments. AEs are the leaders in exporting these products (Figure 5). Since 2015, exports of R&D-related items between AEs have increased by over 20%, but exports to developing economies have dropped by 20% (Figure 6). China hasn’t been able to make up for this decline—its exports of these high-tech products have also fallen.

This suggests that developing economies are not receiving enough of the most advanced technologies. One possible reason is the lack of technical know-how and infrastructure needed to adopt and implement cutting-edge LCTs from AEs. This is why investments from multilateral development banks (MDBs) in things like green energy infrastructure and support for improvements in the policy environment are crucial. They can contribute to helping these economies adopt and make the most of LCTs, including those from AEs.

Restrictive Trade Measures on the Rise

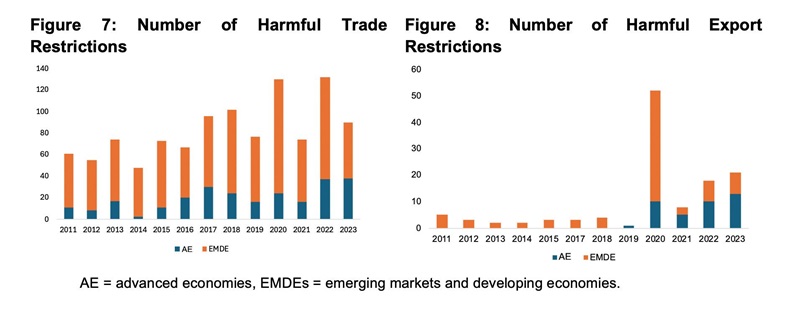

The gap in LCT access could widen further due to increasing trade restrictions. These measures, often intended to protect domestic industries and reduce reliance on imports, can slow global technology adoption. The most common restrictions are import tariffs, accounting for about 70% of these measures, followed by non-tariff barriers like import licensing requirements and bans. While trade restrictions were historically more common in EMDEs, AEs have ramped up their use in recent years. In 2023, AEs accounted for 42% of new trade restrictions on LCT despite making up less than 20% of the dataset (Figure 7).

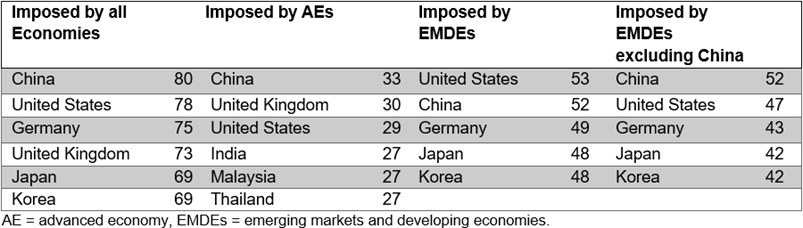

Most of the trade restrictions in 2022 and 2023 are linked to growing tensions between China, the United States (US), and the EU. The products most affected by tariffs include machines and mechanical appliances, solar energy reflectors, and electrical transformers for renewable energy. Trade restrictions imposed by AEs primarily affect EMDEs, not just China, but also economies such as India, Malaysia, and Thailand (Table 1). These economies have been affected by restrictions on products like machinery for biofuel production, plastic parts for solar energy systems, electric converters, and advanced solar PV cells, which are high-efficiency solar cells made from semiconductor nanostructures.

AEs are also increasingly adding barriers to exporting LCT—not counting those related to sanctions (Figure 8). Governments might use these restrictions to prevent technology and knowledge from spreading to other economies, which could slow down the development of new climate technologies. These export restrictions mainly target high-tech components used in renewable energy R&D. 20 out of 23 R&D-related products in the dataset were affected by at least one restriction, while about 40% of non-R&D products were not.

Table 1: Main Economies Affected by Harmful Trade Restrictions, by Imposing Economy Group, 2023

The fact that AEs are now engaged in more restrictive trade measures is noteworthy for two reasons. First, it risks further eroding a rule-based trade system. Second, it could significantly shape the development trajectories of EMDEs. In this evolving landscape, it is more important than ever for MDBs to support economies in integrating LCTs into their growth strategies. This includes fostering cross-border connectivity, which helps economies scale up production, access regional markets and strengthen the viability of LCT industries. At the same time, developing economies face high borrowing costs, making it harder to finance renewable energy projects. This underscores the need for financial de-risking strategies to attract private investment and drive sustainable growth in LCT sectors.

List of Databases:

CEPII - BACI

Data Center - Global Trade Alert

ETLA: Environmental Goods and Services in Trade: Building a new assessment framework and an EGS list – case study Finland - Valto

ICSTD: HS Codes and the Renewable Energy Sector

IMF: Tade in Low Carbon Technology Products | Climate Change Indicators Dashboard

WTO | Trade and environmental sustainability