COVID-19 has caused disruptions in every sector imaginable, and it has not spared the infrastructure construction sector. Anecdotally, there are many reports of delays in infrastructure projects, due to supply chain disruptions and low mobility among workers.

This note analyzes the infrastructure sector via the lens of major engineering, procurement, and construction (EPC) contractors that are actively involved in infrastructure projects in Asia. By tracking more recent data of 24 such contractors, it is possible to get insights into the state of infrastructure construction and understand the potential impact of COVID-19 on infrastructure development.1

From a bird’s-eye view, it would seem that infrastructure development is in a fix. Governments have been increasingly devoting more resources to address immediate needs, and infrastructure development is expected to take a back seat. In addition, uncertainties regarding project completion, project financing, and future pipelines amidst lockdowns are surfacing. Notwithstanding these short-term difficulties, our analysis shows that the sector as a whole remains resilient.

Project Pipelines Remain Strong

Although COVID-19 is expected to interrupt infrastructure activity, construction is expected to pick up as countries in Asia, the most prominent construction market, have started planning life after COVID-19. As an early sign of recovery, economic activity resumed after weeks of a shutdown in China, and infrastructure construction has rebounded.2,3 The temporary shock on China’s construction sector is expected to be partially offset by the issuance of local government bonds to boost infrastructure project development.

The construction sector, driven primarily by China and India, is expected to grow at 5.0 percent, and at a compound annual growth rate (CAGR) of 7.4 percent between 2015 and 2024.4 Many governments are expected to ramp up infrastructure construction post-crisis to kickstart economic growth. More specifically, infrastructure construction activity is expected to record a CAGR of 6.4 percent between 2015 and 2024 (Fitch, 2020).5 The current COVID-19 crisis might present some obstacles to these forecasts, but the medium-term outlook for infrastructure and construction remains robust.

Recent Revenue Growth Has Provided Financial Buffers for Some Contractors

The total revenue for the 24 companies analyzed for this study was more than USD700 billion, while the median was about USD10 billion, as the revenue of Chinese contractors skewed the data. The total revenue experienced annual growth of more than five percent from 2017 to 2019.

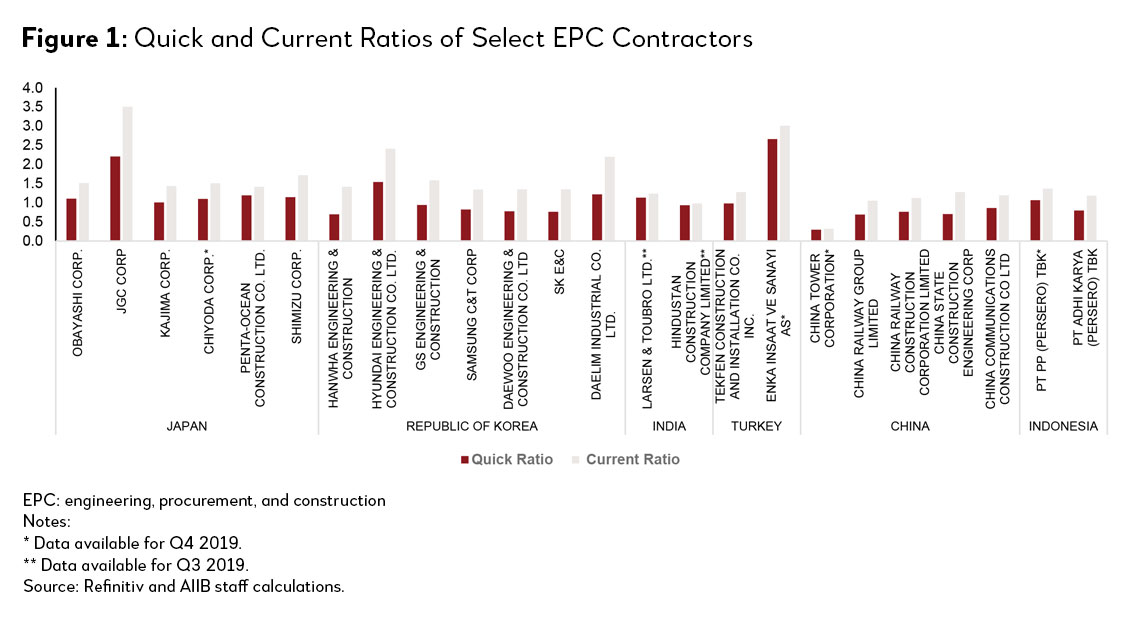

Most of the contractors also boasted high cash reserves, sound financial ratios or both. As of Q1 2020, 18 firms6 had a cumulative cash and cash equivalent balance of USD128 billion, with the Chinese EPC contractors having significant cash in hand (USD91 billion, which comprises the majority of such balance). Further, although the 14 non-Chinese firms might not have similar cash positions, they still had strong quick and current ratios (see Figure 1).7,8 When we assessed the available Q3/Q4 2019 financials of the remaining firms, we found similar results.

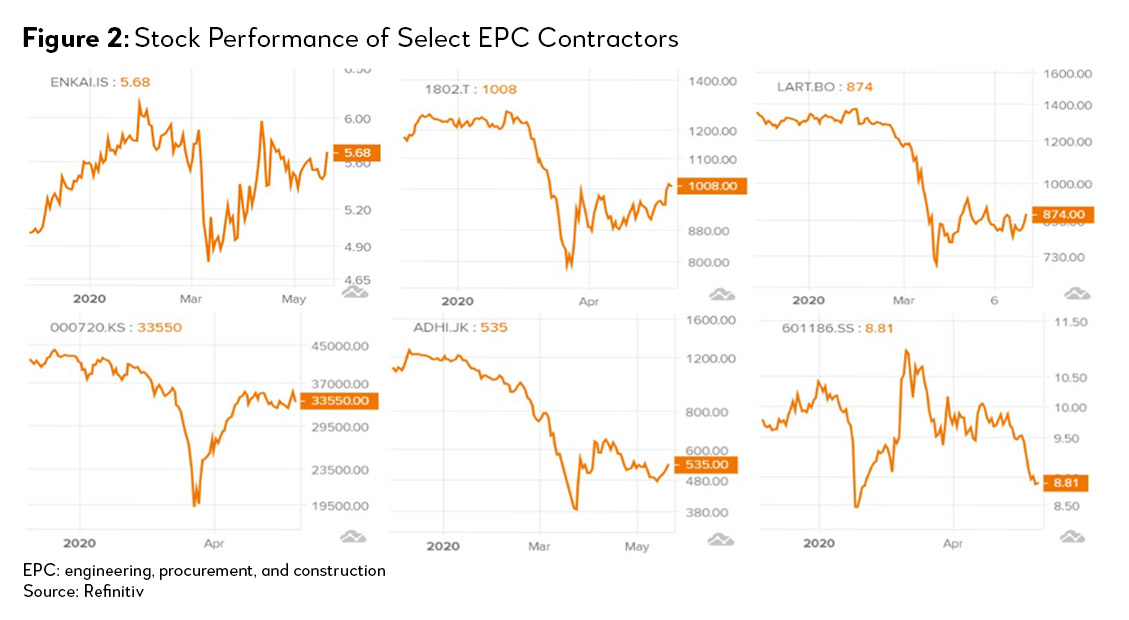

High revenues might not necessarily imply future growth. A proxy for future growth would be stock prices. Stock prices have generally shown some recovery and seem to be on an increasing growth trend (see Figure 2). This trend might have been a result of various governments’ priority on construction even during lockdown.

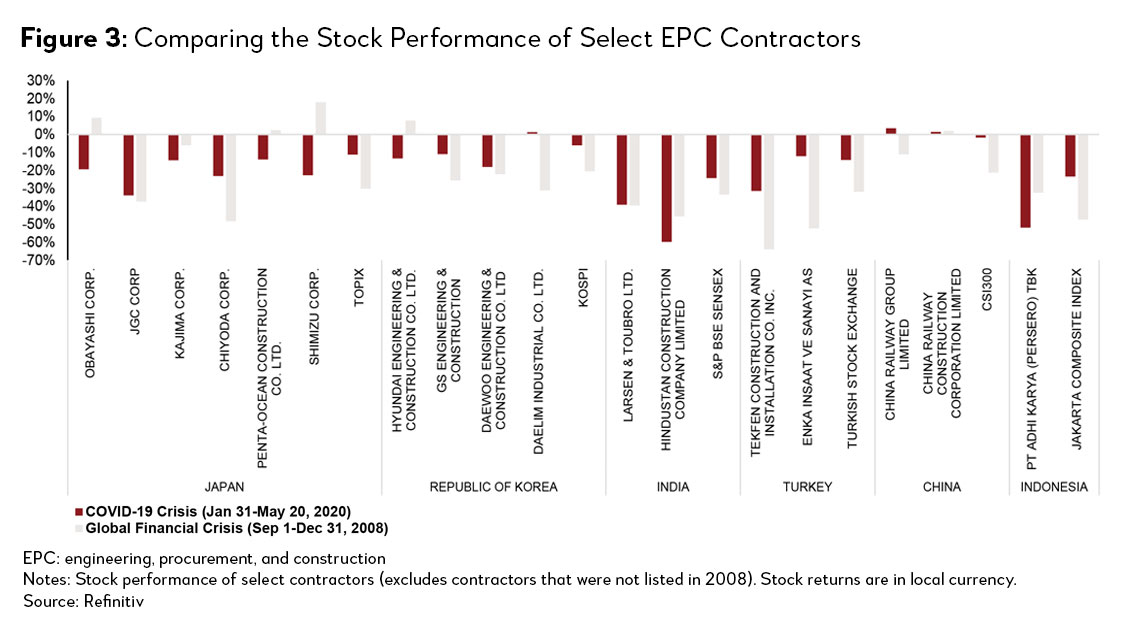

Comparing the changes in stock prices due to COVID-19 and the global financial crisis of 2007-2009, we can observe that the drop in stock prices during the global financial crisis was more pronounced for more than half of the companies (see Figure 3). Nevertheless, companies in India have seen significant price declines, consistent with the difficulties seen in the banking and infrastructure sectors (see Figure 3).

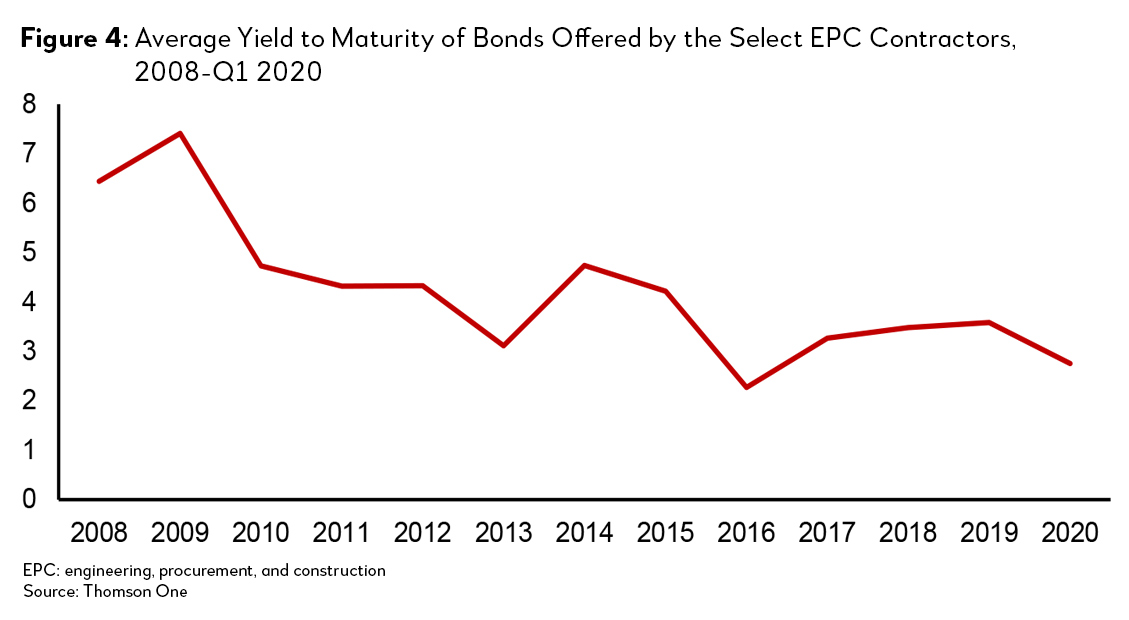

Contractors Have Relatively Healthy Access to Liquidity

Contractors do not face the same credit crunch and high borrowing costs they faced during the global financial crisis. In Q1 2020, total bonds issued by the 24 EPCs were worth USD2.1 billion, 35 percent higher than Q1 2019. So far, in Q2 2020, bond issuance has reached nearly USD3 billion.9 Borrowing costs for contractors have decreased considerably over time (see Figure 4). The average yield to maturity in 2020 is estimated to be 2.75 percent and given that contractors can raise money at such low rates, it is likely that they will not face liquidity problems in the near future.

Infrastructure Sector Still Faces Considerable Uncertainties

While we can be hopeful that infrastructure activity will bounce back, there are uncertainties facing the sector. The trajectory of the epidemic would decide the future and more infections, lockdowns, etc. might exacerbate the current economic slowdown. In case of a protracted economic downturn, EPC contractors could face more problems in the form of non-payments, contract cancellations, and liquidity crunch.

In conclusion, we can see that there is an indication of a pick-up in infrastructure construction as the pipeline infrastructure projects continues to be strong, and as construction has resumed in most Asian markets. Infrastructure EPC firms are also in relatively strong positions: stock price recovery, strong revenues, sound financials and ability to raise money easily should also help their case. Hence, one would expect infrastructure construction to bounce back quickly. However, we should be wary of an uncertain future.

1 We took a sample of 24 EPC contractor companies from the Asian region. The selected companies are mainly from Japan (6), Republic of Korea (7), India (2), Türkiye (2), China (5), and Indonesia (2). The selection was based on ENR Top 250 Global Contractors and Fortune Global 500 - Contractors (2019).

2 Financial Times. 2020. China construction resumes in sign of economic reopening. https://www.ft.com/content/8bf6db54-32c8-47db-b3d8-84aa3885cb31.

3 BMI Research. 2018. Asia Investment Opportunities in Infrastructure: Risk/Reward Analysis Report. https://www.fitchsolutions.com/sites/default/files/2018-07/asia-infrastructure-may2018.pdf.

4 FitchConnect. COVID-19: Assessing the Impact on Construction and Infrastructure. https://app.fitchconnect.com/search/research/article/BMI_A92D668B-6009-4189-AA90-CD69E8C266B1.

5 Asia Pacific Construction Industry Databook Series, Summary Report. https://www.researchandmarkets.com/reports/5006107/asia-pacific-building-construction-industry#rela0-5006108.

6 Q1 2020 data was only available publicly for 18 out of 24 firms.

7 “Quick Ratio” is defined as the ability of a firm’s to make pay its short term obligations (current liabilities) without having to sell inventories or requiring additional finance Quick Ratio = (Current Assets – Inventory – Prepaid Expenses)/Current Liabilities; “Current Ratio” is a measure of liquidity of a company. It is defined as a firm’s ability to pay short-term obligations (current liabilities). Current Ratio = Current Assets/ Current Liabilities.

8 Thomson Reuters Eikon and AIIB staff calculations.

9 Data source of bond issuance data is Thomson One. Data retrieved on May 26, 2020.