WHO WE ARE

WHAT WE DO

- INFRASTRUCTURE FOR TOMORROW

- Overview

- Green Infrastructure

- Connectivity and Regional Cooperation

- Technology-enabled Infrastructure

- Private Capital Mobilization

- Investing in Climate Action

- Gender and Infrastructure

- PROJECTS

- Project Summary

- Project List

- PROJECT STATUS

- Approved Projects

- Proposed Projects

- On Hold

- Terminated/Cancelled Projects

- FINANCING TYPE

- Sovereign Projects

- Nonsovereign Projects

- SPECIAL FUNDS RESOURCES

- Overview

- Project Preparation Special Fund

- Special Fund Window for Less Developed Members

- Project-Specific Window

- Multilateral Cooperation Center for Development Finance Special Fund

- Global Infrastructure Facility Special Fund

- Pandemic Fund Special Fund

- Approved Special Funds Grants

- INSIGHTS AND PUBLICATIONS

- AIIB Blog

- Annual Reports

- Asian Infrastructure Finance

- Sustainable Development Bonds Impact Reports

- AIIB Carbon Footprint Reports

- Ethics Office Annual Report

- COVID-19 Economic and Infrastructure Insights

- Working Papers

- COVID-19 CRISIS RECOVERY FACILITY

- Introduction

- APPROACH TO EMERGENCY RESPONSE

- Introduction

- CLIMATE-FOCUSED POLICY-BASED FINANCING

- Introduction

HOW WE WORK

- ACCOUNTABILITY

- Complaints-resolution, Evaluation and Integrity Unit

- Project-affected People's Mechanism

- Debarment List

- Fraud and Corruption

- PUBLIC CONSULTATIONS

- Project-affected People's Mechanism Policy Review

- CIVIL SOCIETY ENGAGEMENT

- Overview

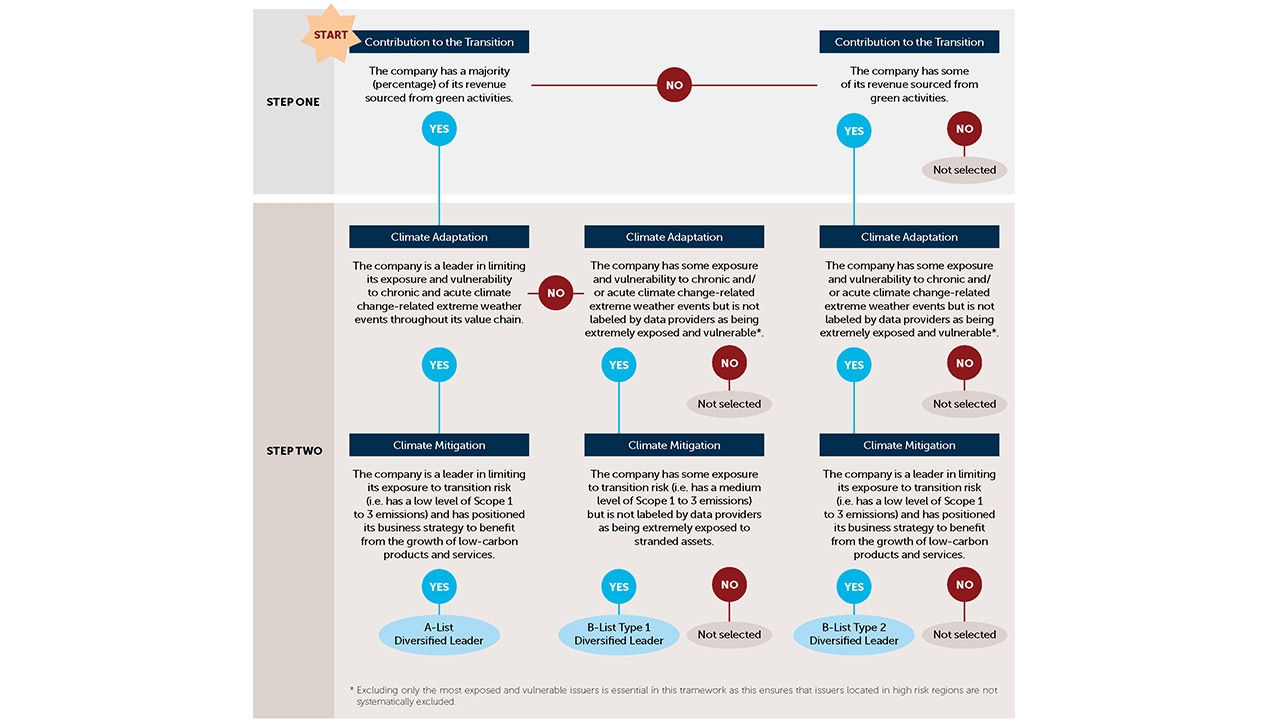

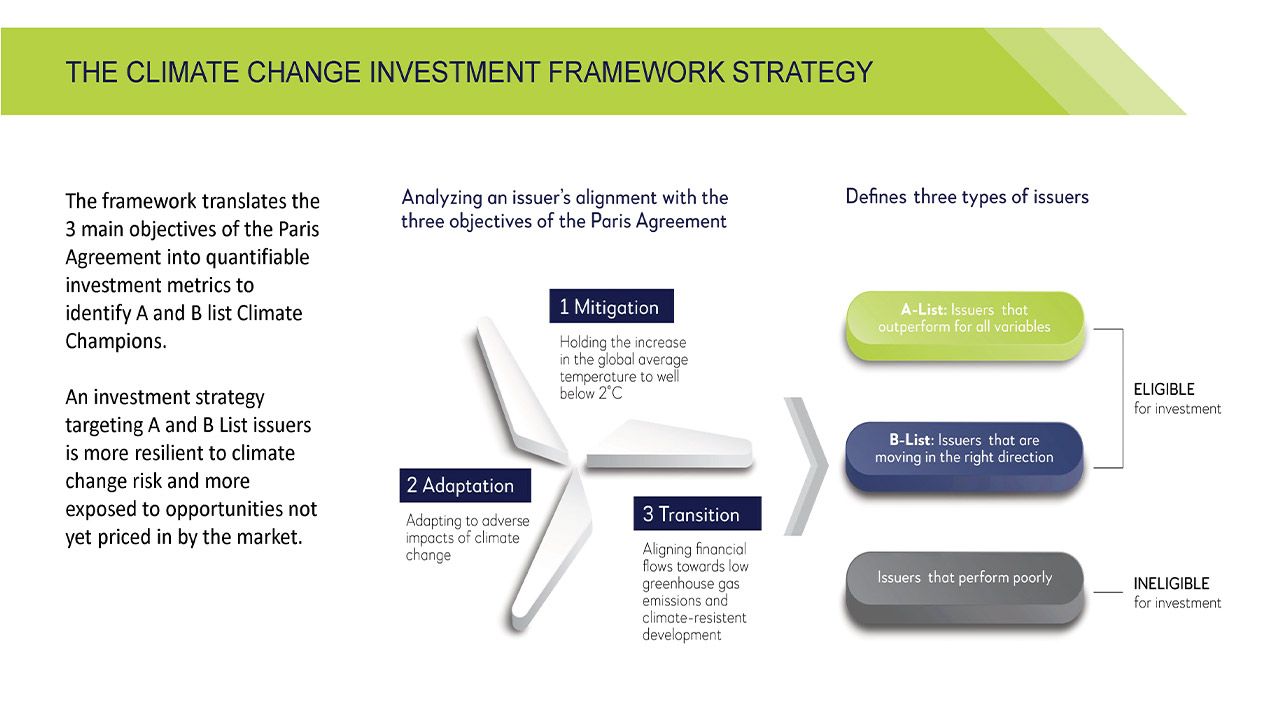

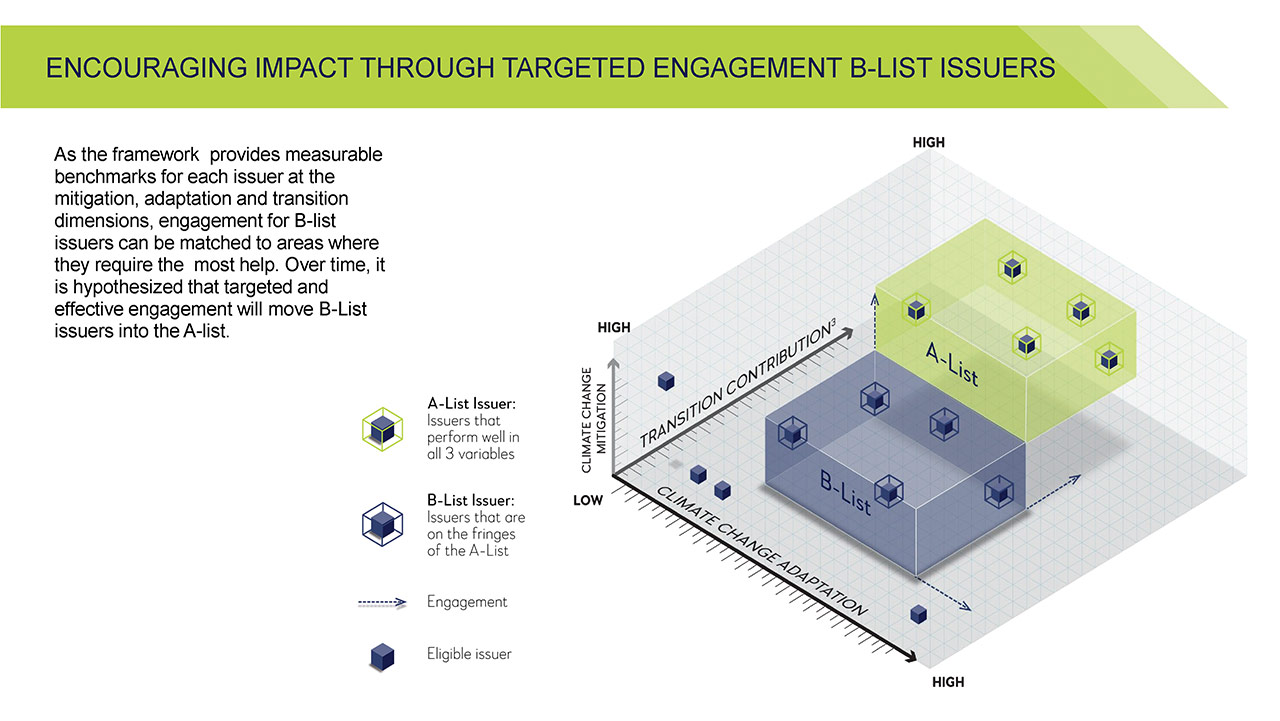

- PARIS ALIGNMENT

- Overview

- Climate Action Plan

- COMPLIANCE

- Overview

- BUSINESS PLAN AND STRATEGIES

- AIIB Corporate Strategy

- Business Plan Summaries

- Energy Sector Strategy: Sustainable Energy for Tomorrow

- Strategy on Mobilizing Private Capital for Infrastructure

- Strategy on Financing Operations in Non-Regional Members

- Transport Sector Strategy

- Sustainable Cities Strategy

- Strategy on Investing in Equity

- Water Sector Strategy

- Digital Infrastructure Sector Strategy

- Health Strategy

- POLICIES AND DIRECTIVES

- Policy on Public Information

- Asset Liability Management Policy

- General Conditions for Sovereign-backed Loans

- Learning and Evaluation Policy

- Operational Policy on Financing

- Operational Policy on International Relations

- Policy on Prohibited Practices

- Policy on the Project-affected People’s Mechanism

- Procurement Policy for Projects

- Policy on Corporate Procurement

- Policy on Personal Data Privacy

- Rules and Regulations of the Project Preparation Special Fund

- Sovereign-backed Loan and Guarantee Pricing

- Directives

WORK WITH US

- BUSINESS OPPORTUNITIES

- Project Procurement Opportunities

- Corporate Procurement Opportunities

- AIIB LEARNING SPACE

- E-learning Modules

- MANAGE MY PORTFOLIO

- AIIB Client Portal

- AIIB+

- SUBMIT A PROPOSAL

- Project Financing Application