2021 marks the first year implementing the Corporate Strategy of the Asian Infrastructure Investment Bank (AIIB). This is a landmark document for the Bank and defines its direction for the next ten years. It is rooted in our understanding of the key dynamics in the Asian infrastructure market and will guide the Bank’s staff in their efforts to provide support to our Members. It strongly reaffirms that we will stay the course in fostering the Bank’s governance, growing our business and moving towards a more mature stage built on the solid foundations that have been laid during its start-up phase. This strategy further delineates our mission for AIIB’s members through our well-informed strategic choices.

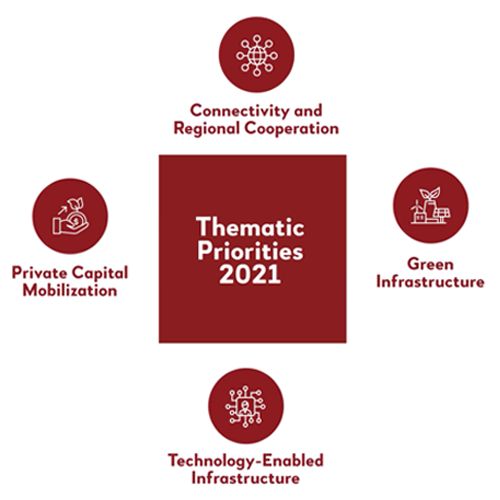

Specifically, our mission is to finance Infrastructure for Tomorrow -- infrastructure that is environmentally, socially and financially sustainable. To this end, we have decided on four thematic priorities essential for the Bank’s market position. We have set our targets on climate finance, cross-border connectivity and private sector financing. Our Corporate Strategy also clarifies our strategic choices for our growth phase as a project finance bank with a business model based on partnerships and mobilization.

In 2021, AIIB approved 51 projects across various sectors worth USD 9.93 billion. Energy, finance, transport and urban projects accounted for the highest shares of approved projects. We also saw private investors turn to AIIB to participate in the issuance of infrastructure asset-backed securities, with increasing interest in digital and technology-enabled projects to spur innovation in the region. Through our focused assistance and careful shepherding of limited resources, we are able to help our Members find ways to meet their growing and changing infrastructure needs under ever more challenging conditions.

We have monitored closely the projects under implementation. As the financings and projects approved earlier are approaching their completion, we are encouraged to see their burgeoning effects generating employment; boosting growth; nourishing under-resources and neglected sectors and expanding opportunities for women, the disabled and the vulnerable groups of people across the countries for which we work. The tangible development in all these aspects is of great importance for sustainable communities. The information collected from the past five years of growth helps us make data-driven decisions so that we can serve our clients and communities better. We see to it that development projects financed by this Bank will be able to sustain growth and promote broad-based economic and social development in our client members. Above all, Infrastructure for Tomorrow must contribute to environmental protection and climate change mitigation and adaptation.

As more client members are looking forward to an economic rebound, the Bank is duty bound to contribute in this process. A heightened sense of urgency to address the forceful impact of climate change emerged from discussions among the world’s leaders and thinkers at COP26. The world is now on the cusp of a situation where failure to attain to the goals of the Paris Agreement will spell grave disasters for the human society. Now is the time to galvanize our collective ambition to tackle the climate crisis and smoothen our transition to a low-carbon and, eventually, a net-zero future.

These are not challenges facing individual countries or companies. Instead, these are global issues where borders are hopelessly irrelevant. Prevailing over these challenges requires a multilateral response, which is why the MDBs are working together in a joint effort against climate change.

2021 marked AIIB’s commitment to align its investment operations with the goals of the Paris Agreement by July 2023. Our aspirations to quickly align our investments are seeded in AIIB’s steadfast commitment to supporting the green economy and a resilient recovery. Based on current estimations, our cumulative climate finance approvals will reach USD50 billion by 2030. These numbers, though ambitious, are within reach.

AIIB and other MDBs must stand as beacons for sustainable growth. As President of AIIB, I had the honor to chair the 2021 meetings of the Heads of the Multilateral Development Banks and it was a valuable opportunity for us to discuss pressing issues affecting development, with pandemic recovery and climate change as two items on the top of our agenda. We discussed strengthening long-term health systems in the context of the global vaccine effort and the importance of continuing their complementary efforts to support countries in combating COVID-19. To address the climate emergency, we are currently working together on a framework of methodologies to implement our collective climate commitments. For MDBs, climate change mitigation and adaptation constitute the essential part of their development mission. This is a formidable challenge. We cannot afford to lose the battle. MDBs will work in close collaboration, and have our collective experience gained in this process inform the strategies to effectively integrate Paris Alignment targets into our respective investment portfolios. This is another value-add of the multilateral system because we have a unique mandate that looks beyond financial performance and considers environmental and social factors.

For all the efforts to wipe it out, COVID-19 is far from being spent. It is gratifying that vaccinations were extended to reach more people across the world in 2021, but there is still a large population in low-income and marginal areas in some countries who have not been serviced. The World Health Organization has not ceased to sound the alarm on the worrying inequality in vaccine access. Furthermore, the new variants of COVID-19 continue to pose threats to the people around the world. With guarded optimism, we expect that the new defenses against the virus will be strengthened, and that disruptions to the global value chain will be checked and the normal pattern of global economic activities will be restored. The world has to continue to grapple with COVID-19 in the foreseeable future.

As long as the pandemic continues, the international community has a moral responsibility to sustain support for countries struggling to distribute vaccines and kickstart broad economic recovery. In this respect, the multilateral development banks have a special role to play. They have taken on a new relevance in stepping up over the past two years to direct funding toward the urgent health and economic issues caused by COVID-19. In 2021, AIIB continued lending for pandemic relief under its COVID-19 Crisis Recovery Facility. As of Dec. 31, 2021, AIIB has approved 45 Facility projects amounting to USD11.1 billion.

Many of our Members still require financial assistance to address their emergency pandemic response and recovery. MDBs remain an important source of countercyclical financing at a time when few options are available. With a mandate that combines social, economic, financial and environmental goals, AIIB is proud to be part of this international coordinated response to support governments and businesses during these uncertain times. Moving forward, financing healthcare will remain an integral component of the mandate of our Bank in the years to come.

While the fight against COVID-19 pandemic is going on and economic recovery is not synchronized across the world, we do not think that our prognosis should be too negative. Some AIIB Members have already begun to shift from emergency response to economic recovery and infrastructure financing. There is huge growth potential in the green economy and green technology. Crowding in more capital to fund these measures will be necessary to fill the financing gap. At the crux of AIIB’s investment strategy is the creation of a financial ecosystem to encourage more private financing for AIIB Members to build resilient infrastructure so they can capitalize on these opportunities as part of their return to growth strategies.

Throughout a very challenging year, our staff continued to operate by high standards, despite many professional and personal challenges. To pay heed to the voices of AIIB staff, we initiated the Staff Consultative Mechanism in 2021 as a constructive platform to facilitate an open dialogue between management and staff on a range of issues from working conditions, interactions between the staff and their supervisors, incentives and recognition of their performance to general wellbeing. A new Diversity and Inclusion Action Plan was also approved by the Executive Committee to support a working environment where all employees feel empowered and are able to bring their talent into full play. These are two essential elements of culture-building among many initiatives, such as a new Ombudsperson’s Office underway at AIIB as we transition from a start-up to a more mature and growth-oriented organization.

Under the guidance of the Board, the management and the staff have worked hard to meet the expectations of our shareholders and a diverse set of stakeholders from around the world. We still have much to learn and an incredible amount of work to do in our efforts to support our members in achieving a prosperous and sustainable Asia. I am pleased with our 2021 Annual Report as it demonstrates what we delivered under challenging circumstances. In this report, we share information about the impacts the Bank exerted on development in the region, the tangible benefits brought to the people, and the contributions we are making to economic recovery and climate change mitigation and adaptation, vaccine access and sustainable infrastructure.

In closing, I would like to extend my thanks to our shareholders, our Board of Directors, our staff and investment partners for their support in 2021 and collectively over the past six years as we continue to invest in Infrastructure for Tomorrow.